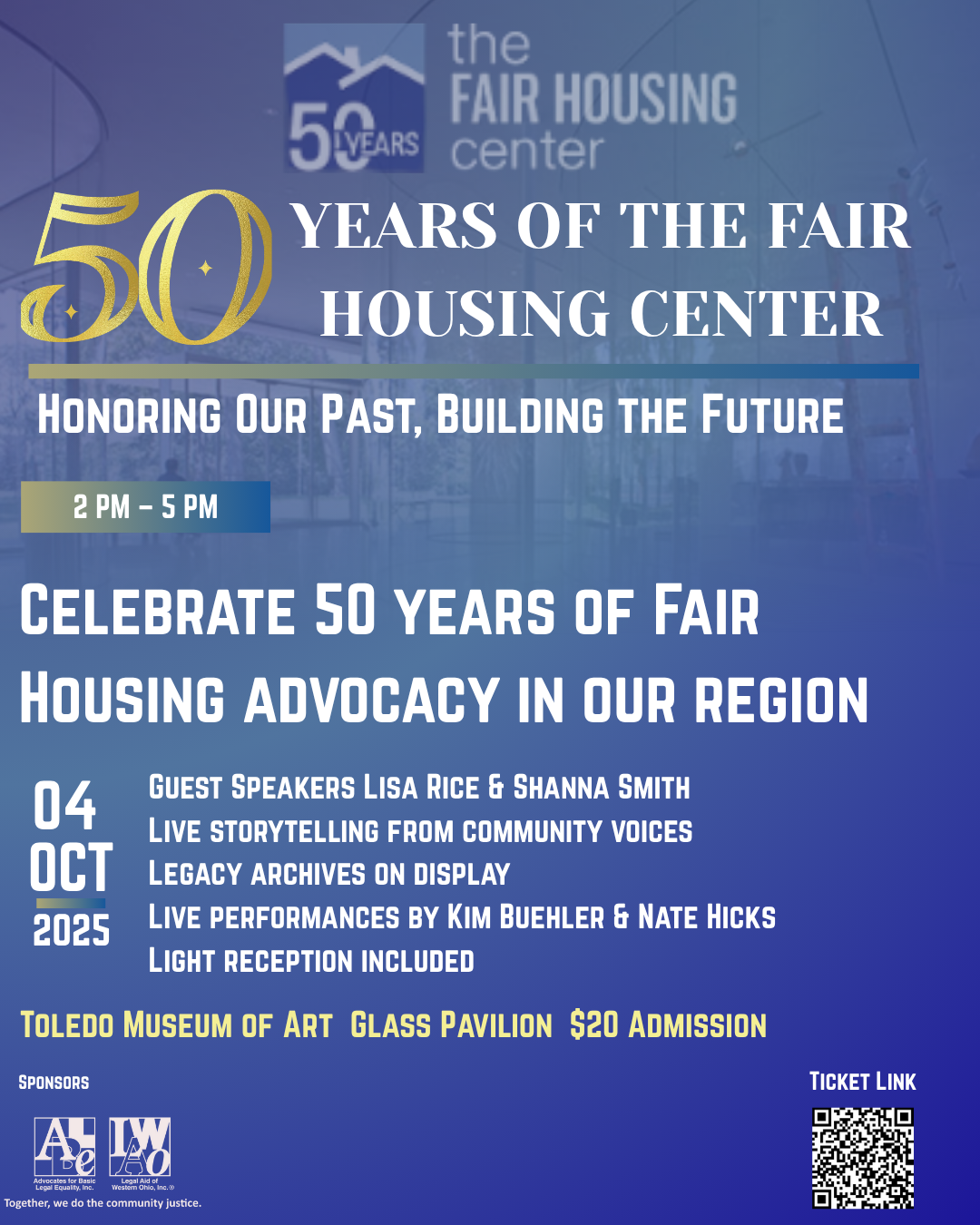

The Fair Housing Center Joins Civil Rights Groups to Announce Filing of Discrimination Complaint Over Neglected Foreclosures in African American and Latino Neighborhoods

Today, The Fair Housing Center will join the National Fair Housing Alliance (NFHA) and other local fair housing organizations to file an amended discrimination complaint against Bank of America (BoA), alleging illegal discrimination in African American and Latino neighborhoods. This new evidence of discriminatory treatment by BoA will be added to the federal Fair Housing Act complaint on file with the U.S. Department of Housing and Urban Development. The complaint is now comprised of evidence from 1,267 BoA properties in 30 metropolitan areas and 201 cities throughout the United States.

“Banks should be creating financial opportunities, not contributing to neighborhood blight,” stated Michael Marsh, President and CEO of The Fair Housing Center. “By failing to maintain and market foreclosed properties in communities of color, Bank of America has played a role in the continued struggle of our neighborhoods of color to recover from the recent housing crisis. The neglected properties in African American and Latino neighborhoods reveal significant racial disparities when compared to White neighborhoods, and this means our communities of color will experience the higher crime rates, increased health risks, and economic disadvantages associated with foreclosures. Bank of America has a responsibility to maintain all of their properties, so that all members of our community have a fair chance to live in a safe, healthy, vibrant neighborhood. Our responsibility is to hold them accountable for that.”

Evidence obtained during this investigation reveals continued failure by Bank of America to perform simple, routine maintenance on its foreclosures in African American and Latino neighborhoods. BoA routinely fails to lock or secure doors and windows, remove trash and debris left by former owners, mow and edge lawns, trim shrubs, and cut back invasive plants. Meanwhile, BoA keeps its foreclosures in white neighborhoods in good condition. Lawns are mowed and edged regularly, and BoA properly disposes of the belongings left behind by former owners. BoA is paid to perform these routine duties in all neighborhoods for all of its foreclosures.

“This disgraceful neglect of foreclosed homes in communities of color is not news to executives at Bank of America. We put them on notice in 2009 and met with them to share photographs of the failed maintenance, but to no avail. It is reprehensible for Bank of America to continue discriminating in African American and Latino neighborhoods all across the U.S.,” said Shanna Smith, President and CEO of NFHA.

Fair housing organizations joining the National Fair Housing Alliance in amending the complaint are located in the following areas: Atlanta, GA; Dallas, TX; Metropolitan Chicago, IL; Milwaukee, WI; Orlando, FL; and Toledo, OH. The National Fair Housing Alliance investigated the foreclosures in Memphis, TN; Baltimore, MD; Philadelphia, PA; and Prince George’s County, MD.

The Fair Housing Act makes it illegal to discriminate based on race, color, national origin, religion, sex, disability, or familial status. It is also illegal to discriminate based on the race or national origin of neighborhood residents. This law applies to housing and housing-related activities, including the maintenance, appraisal, listing, marketing, and selling of homes.

National news conference webinar to announce filing of HUD complaint against Bank of America scheduled for Wednesday, August 31 at 11 a.m. Register for remote access here: BoA News Conference Webinar Link.

Highlights of Significant Racial Disparities in Toledo

Between March 2013 and July 2016, the Toledo Fair Housing Center investigated 40 Bank of America foreclosures in African American, Latino, and White neighborhoods in metro Toledo.

- 50.0% of the Bank of America foreclosures in African American neighborhoods had 10 or more maintenance or marketing deficiencies, while only 8.3% or just 2 of the foreclosures in predominantly White neighborhoods had 10 or more deficiencies.

- 68.8% or 11 out of 16 of the Bank of America foreclosures in African American neighborhoods had substantial amounts of trash on the premises, while only 16.7% or 4 of 24 in predominantly White neighborhoods did.

- 31.3% of the Bank of America foreclosures in African American neighborhoods had unsecured or broken doors, while only 1 of 24 foreclosures in predominantly White neighborhoods did.

- 50.0% or 8 of the Bank of America foreclosures in African American neighborhoods had damaged steps or handrails, while only 16.7% or 4 of 24 of the foreclosures in predominantly White neighborhoods did.

View photos of neglected properties here.

Full national statistics, maps, and data for individual cities available at www.nationalfairhousing.org.

###

The Fair Housing Center

Vision

The Fair Housing Center will be a leading visible force in preventing and correcting discriminatory practices.

Mission

The Fair Housing Center is a non-profit civil rights agency dedicated to the elimination of housing discrimination, the promotion of housing choice and the creation of inclusive communities of opportunity. To achieve our mission, the center engages in education and outreach, housing counseling, advocacy for anti-discriminatory housing policies, research and investigation, and enforcement actions.

The work that provided the basis for this publication was supported by funding under a grant with the U.S. Department of Housing and Urban Development. The substance and findings of the work are dedicated to the public. The author and publisher are solely responsible for the accuracy of the statements and interpretations contained in this publication. Such interpretations do not necessarily reflect the views of the Federal Government.